If you’re building a social network, community, SaaS or anything similar to that, these are the only things that really matter:

- Growth

- Engagement

- Monetization

And not necessarily in that order.

My friend, Nir Eyal, refers to startups that have these things as GEMs (get it?). Whenever he invests in startups, he looks for products that have at least two of those, and a plan for the third.

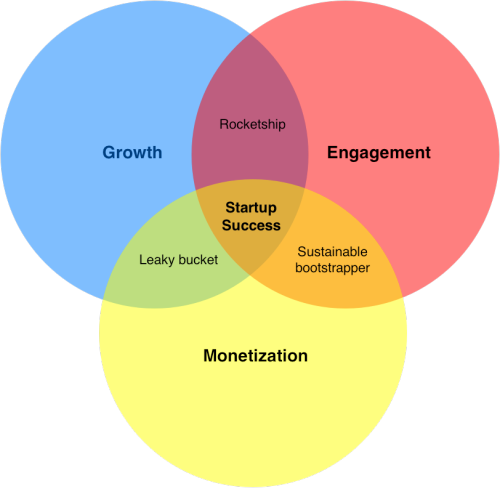

So, I created this quick Venn diagram illustrating why Growth, Engagement, and Monetization are so important:

To be clear, most startups do not have all three things. If they did, they wouldn't be startups anymore – especially if you define a startup as a “company working to bring a product or service to market under conditions of extreme uncertainty.” For each element that the company figures out, the level of uncertainty will be reduced.

A company can reach some sort of success with only two elements, but to make it really big it will need all three. Also, a company will see very different kind of traction depending on which two of the elements it has figured out.

Growth & Engagement: Rocketship

A company that manage to grow the user base quickly and keep them engaged and coming back regularly will likely grow big very quickly. Hence the name rocketship. As long as they raise capital to support the growth, there are no immediate problems with this situation. But eventually they need to stop losing money, and make money instead. If they do not figure out how in time, the rocketship will run out of fuel and crash.

Engagement & Monetization: Sustainable bootstrapper

If a company manage to create an engaging product, and at the same time make money from the modest user base that they do have, they will likely have a solid, profitable business. But if they never figure out how to sustainably and rapidly grow their user base, they will never make it really big.

Monetization & Growth: Leaky bucket

Last, but not least, a company that manage to get a lot of users quickly, and make money off them, will definitely be able to make a quick buck. But if they are not able to keep users over time, they are a leaky bucket. The company can probably be quite profitable for a while, but it will need to keep “refilling the bucket” with new users. And because marginal user acquisition costs tend to rise over time (it’s cheap to recruit the people that really want your product, but much more expensive to recruit the ones that are less interested), it can ever only go one way. Unless the company figure out how to make their users stick around, that is.

Note: This model does obviously not take into account the operational side of startups, but that’s really not the point either.